- Main

- Business & Economics - Accounting

- Income Tax Fundamentals 2020

Income Tax Fundamentals 2020

Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill¿Qué tanto le ha gustado este libro?

¿De qué calidad es el archivo descargado?

Descargue el libro para evaluar su calidad

¿Cuál es la calidad de los archivos descargados?

Learn the complexities of the U.S. income tax code and master the most important areas of tax law with Whittenburg/Altus-Buller/Gill's concise, practical INCOME TAX FUNDAMENTALS 2020. This market-leading introduction to tax preparation uses a unique, step-by-step workbook format that integrates actual tax forms. You have the option to use Intuit ProConnect 2019 tax preparation software that accompanies each new book. A clear, up-to-date presentation walks you through real, current examples using the most recent actual tax forms. A variety of end-of-chapter problems offer hands-on practice with tax return problems that use source documents identical to those of real clients. In addition, numerous study tools and powerful online resources, including MindTap digital support and the CengageNOWv2 online homework tool, help you further refine the knowledge and skills to become a successful tax preparer.

Categorías:

Año:

2019

Edición:

38

Editorial:

Cengage Learning

Idioma:

english

Páginas:

848

ISBN 10:

035710823X

ISBN 13:

9780357108239

Archivo:

PDF, 123.59 MB

Sus etiquetas:

IPFS:

CID , CID Blake2b

english, 2019

Descargar (pdf, 123.59 MB)

- Checking other formats...

- Convertir a

- Desbloquea la conversión de archivos de más de 8 mbPremium

¿Quieres añadir una librería? Contáctanos a través de support@z-lib.fm

El archivo se enviará a su dirección de correo electrónico durante el transcurso de 1-5 minutos.

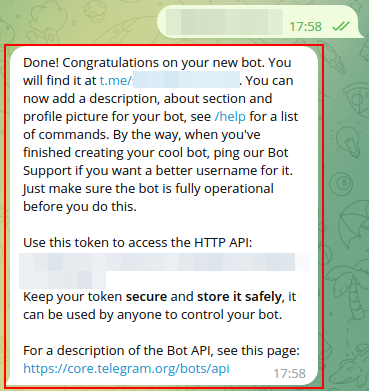

El archivo será enviado a tu cuenta de Telegram durante 1-5 minutos.

Atención: Asegúrate de haber vinculado tu cuenta al bot Z-Library de Telegram.

El archivo será enviado a tu dispositivo Kindle durante 1-5 minutos.

Nota: Ud. debe verificar cada libro que desea enviar a su Kindle. Revise su correo electrónico y encuentre un mensaje de verificación de Amazon Kindle Support.

Conversión a en curso

La conversión a ha fallado

Beneficios del estado Premium

- Envía a dispositivos de lectura

- Mayor límite de descargas

Convierte archivos

Convierte archivos Más resultados de búsqueda

Más resultados de búsqueda Otros beneficios

Otros beneficios

Términos más frecuentes

Listas de libros relacionados

Amazon

Amazon  Barnes & Noble

Barnes & Noble  Bookshop.org

Bookshop.org

![Adrian Raftery [Raftery, Adrian] — 101 Ways to Save Money on Your Tax--Legally! 2020--2021](https://s3proxy.cdn-zlib.se/covers200/collections/userbooks/f8995594b24b415b412713aea38fd09c726ff57b93de44b051e67a915b83c3b3.jpg)